Posts by Karen

We’ve been shortlisted!

Well done to our Private Client team who have been shortlisted in the ‘Team of the Year’ category for the Devon & Somerset Law Society Legal Awards 2020. The Awards ceremony will be held on Thursday, 30th April – we’ll be there, sitting with our fingers crossed under the table! Wish us luck!

Read MoreA New Year review

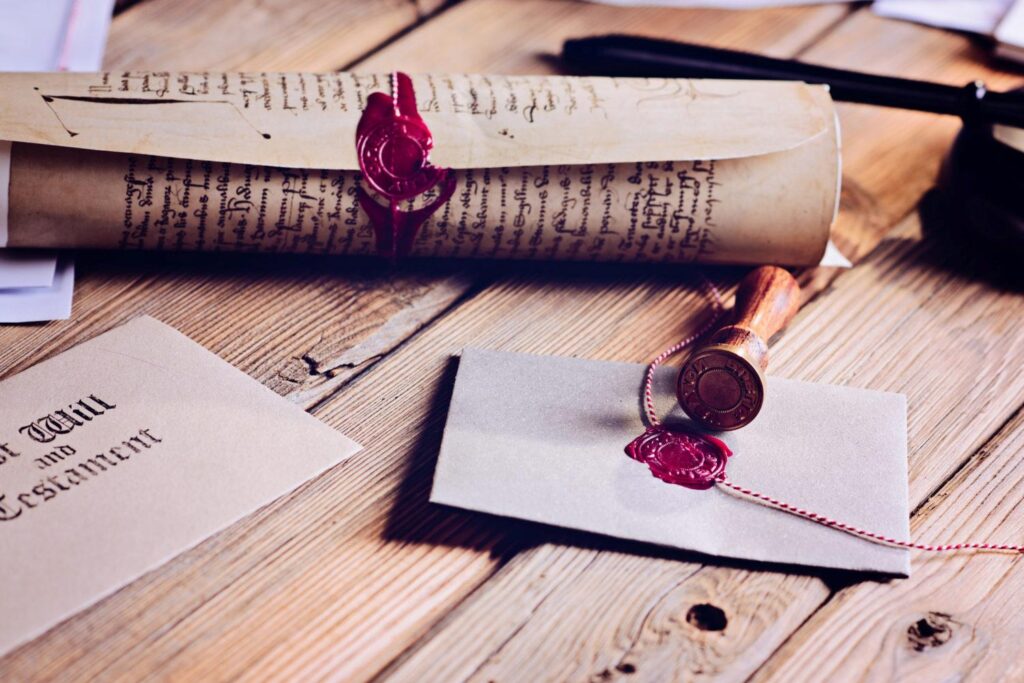

We are now into a new year and although you may have contemplated your New Year’s resolutions, did you give any thought about making or reviewing your will or power of attorney? At an already difficult time when such documents are required, taking care of these matters beforehand ensures less worry for your family and…

Read More